Table of Contents

- The 2025 holiday demand curve and the AI effect

- Meta Ads holiday season 2025, Advantage Plus that actually scales

- Structure that works on peak weeks

- Creative that converts during gifting season

- Signals and measurement that survive privacy noise

- Budgeting and pacing across November, December, and Q5

- Google Ads holiday season 2025, Performance Max as the engine

- Feed and site quality are non negotiable

- Asset excellence and creative depth

- Bidding and budgeting for volatile days

- First party data is the multiplier

- TikTok Ads and TikTok Shop, GMV Max, LIVE, and attribution clarity

- Practical setup that holds under pressure

- Dual channel strategy

- Budget allocation and scenario planning across US and Europe

- Creative system that wins in 2025

- Measurement in a privacy centric year

- Platform comparison, strengths and watch outs

- Your operating checklist and templates

- What to do next if you are starting today

- From Planning to Profit, Holiday Season 2025

The 2025 holiday demand curve and the AI effect

Holiday Season 2025 is set to be the first quarter trillion dollar online season in the United States, with Adobe forecasting 253.4 billion dollars in ecommerce from November through December, a five point three percent lift year over year. Early deals already pushed October online spend to 88.7 billion dollars, up eight point two percent from 2024, a sign that demand is spreading across a longer window. [1][2]

AI is changing shopper journeys in measurable ways. Salesforce estimates AI agents and assistants will influence as much as 263 billion dollars in global holiday sales in 2025, with rapid growth in AI referred traffic and stronger conversion rates than many traditional sources. Retailers that structure product data and content for AI discovery stand to capture disproportionate gains. [3][4]

For media planners, the takeaway is simple, plan for a longer ramp, build AI friendly product and content feeds, and prepare to scale fast during Cyber Week while sustaining spend into the late season and the Q5 window in January. Adobe and Salesforce guidance suggest this pattern is durable across US and Europe, with value seeking behavior and mobile dominated shopping continuing to rise. [1][3]

Human first UGC with fast hooks drives Meta scale.

Meta Ads holiday season 2025, Advantage Plus that actually scales

Meta’s automation suite, especially Advantage Plus Shopping Campaigns, remains the most reliable engine for blended prospecting and retargeting when volume spikes. Advantage Plus bundles creative and audience expansion, which reduces the need for heavy segmentation and lets the model find incremental buyers across placements. Meta’s holiday hub reinforces creator forward creative, Reels first formats, and flexible budgets that lean in during Cyber Week and continue into Q5. [7][8]

Structure that works on peak weeks

Advantage Plus Shopping as the main scale campaign, one always on retargeting set as your safety net, and one test lane for new offers or bundles. Keep geography and language constrained to your market, allow broad audience in Advantage Plus, and feed the system with at least ten to twenty distinct creatives so learning is not bottlenecked by too few assets. Meta’s own product documentation and field guides emphasize automation, creative volume, and strong commerce signals. [7][8]

Creative that converts during gifting season

Prioritize human presence, real hands and faces, and quick value delivery in the first two to three seconds. Use vertical nine by sixteen video, voiceover or captions for sound off, and show problem to payoff sequences with a clear offer. Meta’s holiday guidance highlights creator collaborations and Reels native storytelling for attention and conversion. [7]

Signals and measurement that survive privacy noise

Enable Conversions API with deduplication so purchase events are resilient. Validate event match quality and pass parameters like value and currency. When automated systems take more control, aggregate metrics, lift tests, and incrementality readouts become more important than last click only views. Use Meta’s CAPI best practices and plan lift tests early. [9]

Check out this fascinating article: Black Friday 2025 Ad Playbook, Meta, Google, And TikTok That Actually Convert

Budgeting and pacing across November, December, and Q5

Grow spend through early November as pools warm, then step up sharply for Black Friday through Cyber Monday. Sustain with weekly creative refresh, then pivot to gift card and last mile messaging after shipping cutoffs in late December. Keep powder dry for Q5 in January when audiences are warm and CPMs soften.

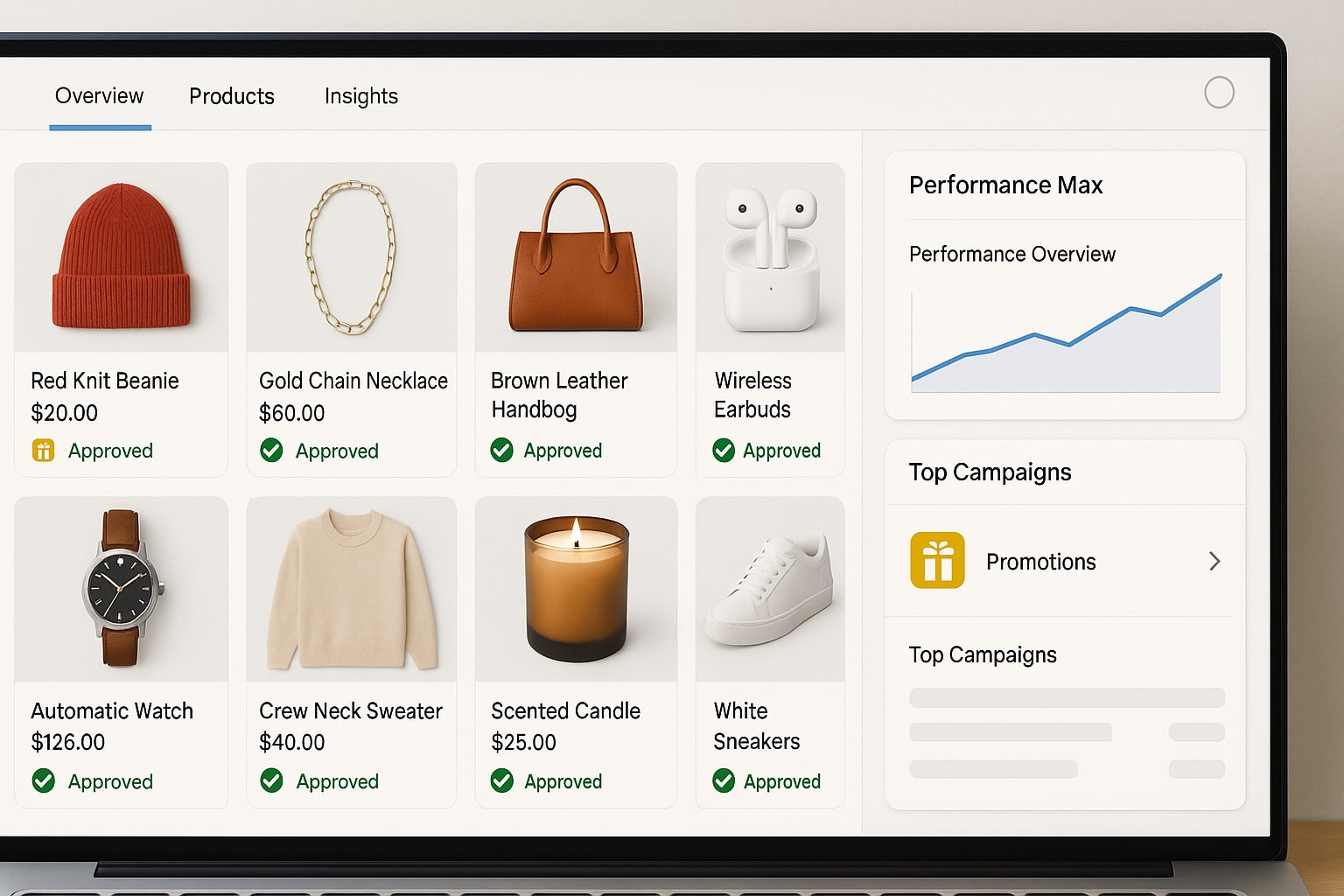

Feed quality and first party data power PMax.

Google Ads holiday season 2025, Performance Max as the engine

Google confirmed new Performance Max features in 2025 focused on transparency and controls while keeping AI at the core. Think with Google’s retail insights stress first party data, product feed quality, and full funnel asset strength to capture high intent demand across Search, Shopping, YouTube, and Discover. [5][6]

Feed and site quality are non negotiable

Fix disapprovals and enrich product data in Merchant Center, include attributes like size, color, material, and promotion annotations, and keep availability accurate. Optimize landing pages for speed and clear shipping cutoff messaging. Google’s guidance continues to show that better product data and page experience correlate with stronger incremental conversions. [6]

Asset excellence and creative depth

Map asset groups to product themes or price tiers. Provide ample text and image video options so the model can assemble best combinations per context. Use seasonally relevant hooks like under twenty five gifts, bundle and save, and last order dates. Google’s 2025 roadmap makes it easier to see what assets drive performance so you can lean into winning combinations. [5]

Bidding and budgeting for volatile days

Use value based bidding with clear ROAS or CPA guardrails. Apply seasonality adjustments only when you have predictable uplift patterns. Set rules for daily budget increases when marginal ROAS is on target, and caps when conversion rate falls below your floor.

First party data is the multiplier

Upload customer lists where lawful, enable enhanced conversions, and let Google’s models learn from your real purchase outcomes. First party data remains a primary lever to teach AI what good looks like and to keep relevance high in privacy centric environments. [6]

LIVE commerce and GMV Max push late season conversion.

TikTok Ads and TikTok Shop, GMV Max, LIVE, and attribution clarity

TikTok’s 2025 Holiday Playbook describes a full funnel operating system for commerce. Smart Plus Catalog and GMV Max are built to scale exposure for hero SKUs, while LIVE programming during Cyber Week gives conversion surges. TikTok guidance recommends at least forty nine creatives in GMV Max and daily LIVE rhythm in peak weeks. [10]

TikTok also offers Post Purchase Surveys in Ads Manager to close attribution gaps between web and Shop and to reconcile differences with GA4 or third party analytics. The program is open beta and is designed to be lightweight to deploy. [11]

Practical setup that holds under pressure

Start with Smart Plus Catalog and at least six creatives to train the system, add new variations weekly. Spin up GMV Max for Cyber Week and December to scale efficiently. Layer Interactive Add Ons like countdowns and flash sale stickers to push urgency for late buyers. Schedule one to two LIVE sessions daily through Cyber Week, three hours each, and treat them like storefront hours. [10]

Dual channel strategy

Run to both web and TikTok Shop when feasible. TikTok’s internal guidance shows better total GMV when brands allow users to purchase in their preferred environment and retarget across both surfaces. Use PPS and conversion lift where possible to prove incrementality. [10]

Budget follows demand, guardrails protect efficiency.

Budget allocation and scenario planning across US and Europe

Start November with a balanced split. Many retailers will over index on Google early because of high intent search, then lean into Meta and TikTok as creative and offers find product market fit. A sample pattern that works for mid market ecommerce, pre peak Meta thirty five, Google forty five, TikTok twenty. Cyber Week Meta forty, Google forty, TikTok twenty as you push creative rotation and LIVE. Early December revert toward Google forty five as you ride branded and generic Shopping, keep Meta mid funnel strong, and give TikTok consistent budget to maintain discovery. After shipping cutoffs, shift spend toward gift cards and local inventory with stronger Google presence, then push back to Meta and TikTok during Q5 when CPMs fall and audiences are warm.

These splits are starting points. Use MER and marginal ROAS to adjust daily. Read Adobe’s season progress indicators and Salesforce AI influence updates to anticipate demand waves. [1][3]

Check out this fascinating article: Black Friday 2025 TikTok Shop Playbook: How to Turn GMV Max into Real Sales

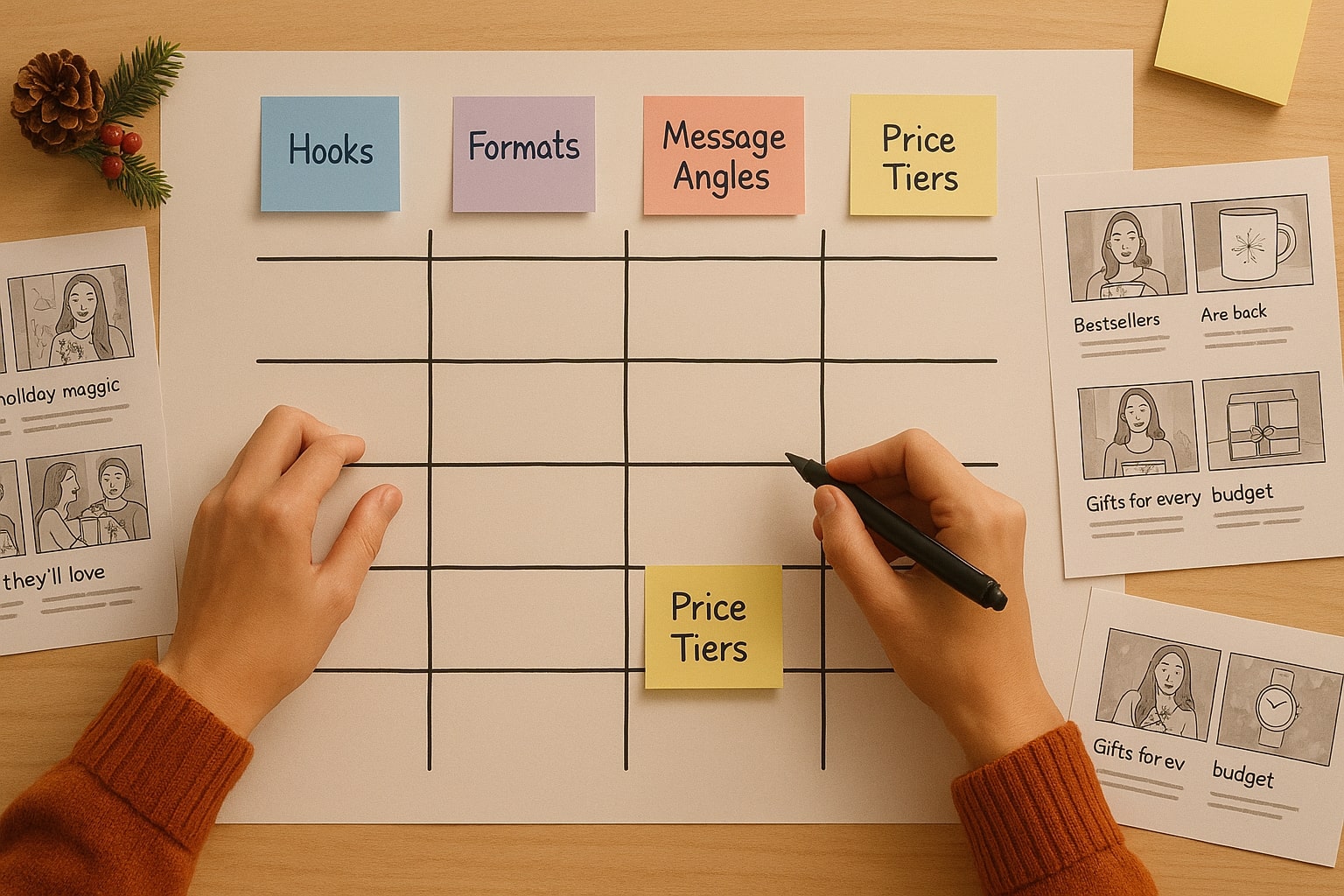

Creative system that wins in 2025

Treat creative as a portfolio, not a single ad. Use a matrix of human led formats that AI systems can recombine.

Hooks that perform in holiday gifting, problem to payoff in two seconds, side by side before after, gift guide by price, creator testimonial with star ratings overlay, unboxing with captions.

Formats by platform, Meta Reels vertical video and collection ads, Google PMax with strong product images and YouTube verticals, TikTok nine by sixteen UGC and LIVE with host on camera.

Message architecture, start with pain relief and gifting role, add social proof, end with urgency and clear benefit. This aligns with official platform guidance that prioritizes human presence, fast hooks, and frequent refresh. [7][10]

Measurement in a privacy centric year

Use platform lift and in platform surveys when possible, Meta Conversion Lift, TikTok Post Purchase Survey, geo holdouts or controlled tests where scale allows. Link GA4 to TikTok Attribution Analytics to reduce reporting mismatches. For Google Ads, rely on modeled conversions with enhanced conversions and value based bidding to manage to outcomes rather than isolated clicks. These steps reflect platform documentation in 2025 and help defend budgets with finance teams. [11][9][5]

Platform comparison, strengths and watch outs

| Area | Meta | TikTok | |

|---|---|---|---|

| Core product for peak | Advantage Plus Shopping, Reels, Catalog | Performance Max with Merchant Center | Smart Plus Catalog, GMV Max, LIVE |

| Where it shines | Scales creative faster, strong broad prospecting and retargeting | Captures declared intent across Search and Shopping with high buyer readiness | Drives discovery and impulse, creator social proof, LIVE conversion surges |

| Data requirements | Pixel and Conversions API with dedupe and high event match quality | Merchant Center feed quality, enhanced conversions, first party audiences | TikTok Shop or web with TikTok pixel, PPS and GA4 link for attribution |

| Creative guidance | Human first UGC, fast hooks, vertical video, creator collabs | Strong product images and price clarity, YouTube verticals, themed asset groups | Human on camera, creator storytelling, urgency add ons, frequent refresh |

| Measurement | Conversion Lift, aggregate performance, modeled conversions | PMax reporting with asset insights, MMM or experiments where possible | Post Purchase Surveys, conversion lift, attribution analytics |

Sources for features and measurement can be found in platform hubs and product docs. [5][6][7][8][10][11]

Your operating checklist and templates

Grab the ready to use planner and checklist workbook. It includes phase plans, Meta, Google, and TikTok setup lists, a creative matrix, measurement plan, daily ops tracker, UTM builder, and QA preflight.

Download the checklist

Download the Holiday Season 2025 Ad Playbook Checklist

What to do next if you are starting today

Lock your product and offer map, finalize shipping cutoffs and gift card plan, and align budget rules for Cyber Week. Ensure Meta CAPI and Google enhanced conversions pass value and currency. Launch TikTok PPS and plan daily LIVE windows during Cyber Week. Refresh creatives weekly across all platforms. Use lift and incrementality readouts to guide budget into late December and Q5. This workflow mirrors current platform guidance in 2025 and reflects how leading retailers are adapting to AI shaped demand. [5][7][10][11]

From Planning to Profit, Holiday Season 2025

Holiday performance belongs to teams that decide fast and test relentlessly, not to teams that only analyze. Put the checklist to work, turn on your incrementality reads, and let the platforms’ AI do the heavy lifting while you keep offers and creatives fresh. If you have a thorny question or want a second set of eyes on your media plan, drop a comment or ask away, the best insights often start with a simple what if.

References

- Adobe — US holiday online sales forecast to $253.4B, 2025 ↩

- Adobe — October 2025 online spend $88.7B, YoY +8.2% ↩

- Salesforce — AI and agents present a $263B holiday opportunity, 2025 ↩

- Digital Commerce 360 — Salesforce AI assistant traffic and conversion insights, 2025 ↩

- Google — New Performance Max features in 2025 ↩

- Think with Google — Retail marketing insights with AI, 2025 ↩

- Meta — Holiday Marketing Hub, 2025 ↩

- Meta — Advantage Plus overview, 2025 ↩

- Meta — Conversions API best practices ↩

- TikTok — NA SMB Holiday Playbook 2025, Smart Plus and GMV Max ↩

- TikTok — Post Purchase Survey help article ↩

- TikTok — Holiday hub and playbook access, 2025 ↩